Minutes, not days: compliance-first onboarding that actually ships

One-session onboarding for investors, issuers, and brokers—without sacrificing compliance.

Most firms still take days (or weeks) to complete KYC/KYB and agreements. Here’s how Liquidity’s Simplici flow compresses onboarding to minutes while strengthening auditability.

For both issuers and investors, onboarding still mirrors a paper era. Multiple portals, repeated data entry, and manual checks stall capital formation and frustrate allocators and brokers. The result: broken funnels, higher CAC, and compliance risk concentrated at the edge.

Real-world frictions we hear every week:

Fragmented KYC/KYB across vendors; repetitive questionnaires and identity steps.

Manual reviews for facial similarity/liveness, sanctions, PEP, and adverse media.

Chasing ATS/subscription agreements and e-signature reconciliations.

Data silos—no single audit trail across investor, issuer, and broker workflows.

Elapsed time in days, driving drop-offs and costly rework.

Liquidity.io unifies onboarding with Simplici—a compliance-first flow that lets an accredited investor, a broker, or a compliant issuer complete required steps in one session: biometric + liveness, KYC/KYB, programmatic questionnaires, and execution of required agreements—all tied to an auditable record and policy engine.

What this looks like by role

Investors/allocators: Biometric + liveness → KYC → tailored questionnaires → execute applicable ATS/subscription docs—typically in minutes, subject to screening outcomes.

Issuers/company owners: Create the company via EquityTable (equitytable.io) → upload/shareholder registry → KYB and controllers → disclosures & agreements.

Brokers/introducers: KYC, short-form policy questionnaires, and agreement execution with monitoring hooks.

Feature snapshot (tailored to you)

Single-pass identity & compliance: Biometric, KYC/KYB, sanctions/PEP, forms, and agreements in one guided flow.

Policy-driven questionnaires: Dynamic branching, audit timestamps, and evidence capture.

E-sign with controls: Signature verification plus supervision flags aligned to FINRA guidance.

End-to-end auditability: Immutable events log, exportable evidence pack, and integration-ready APIs.

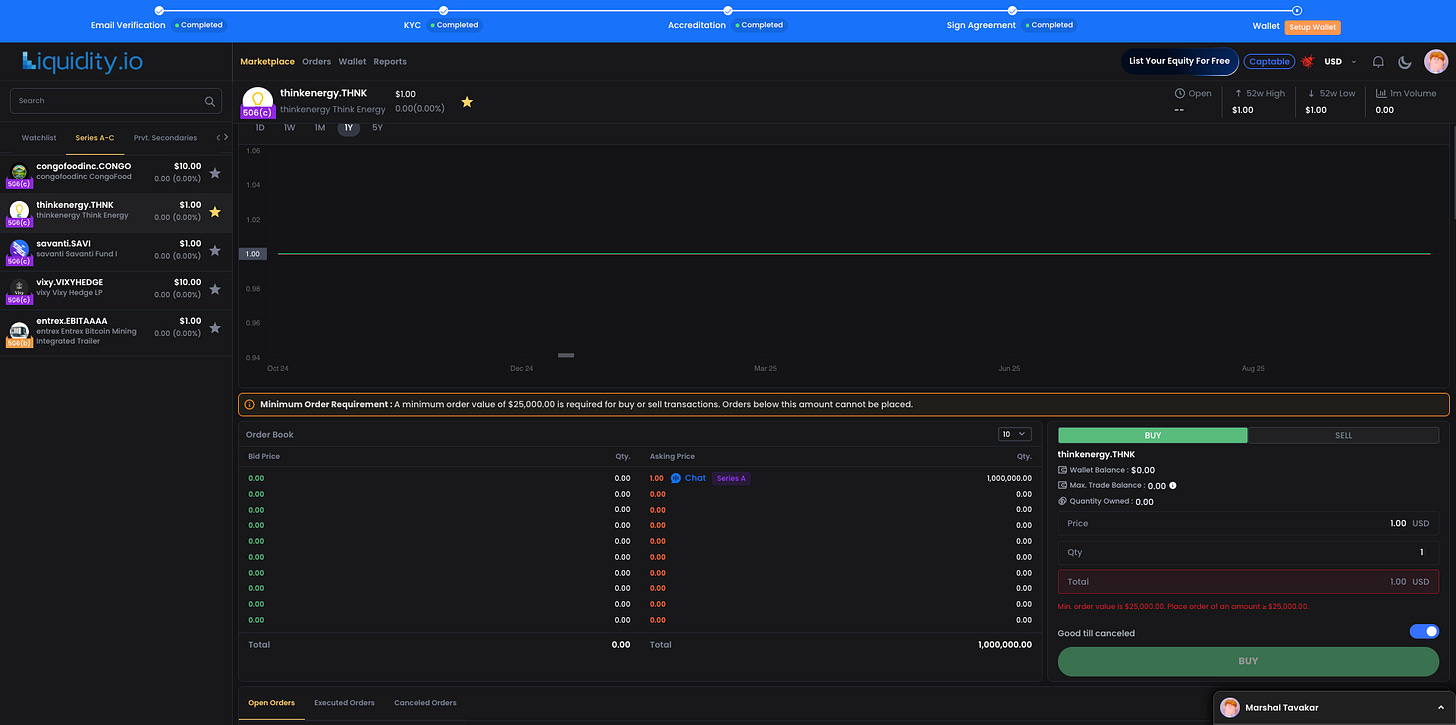

Caption: Liquidity.io, Our Exchange Platform

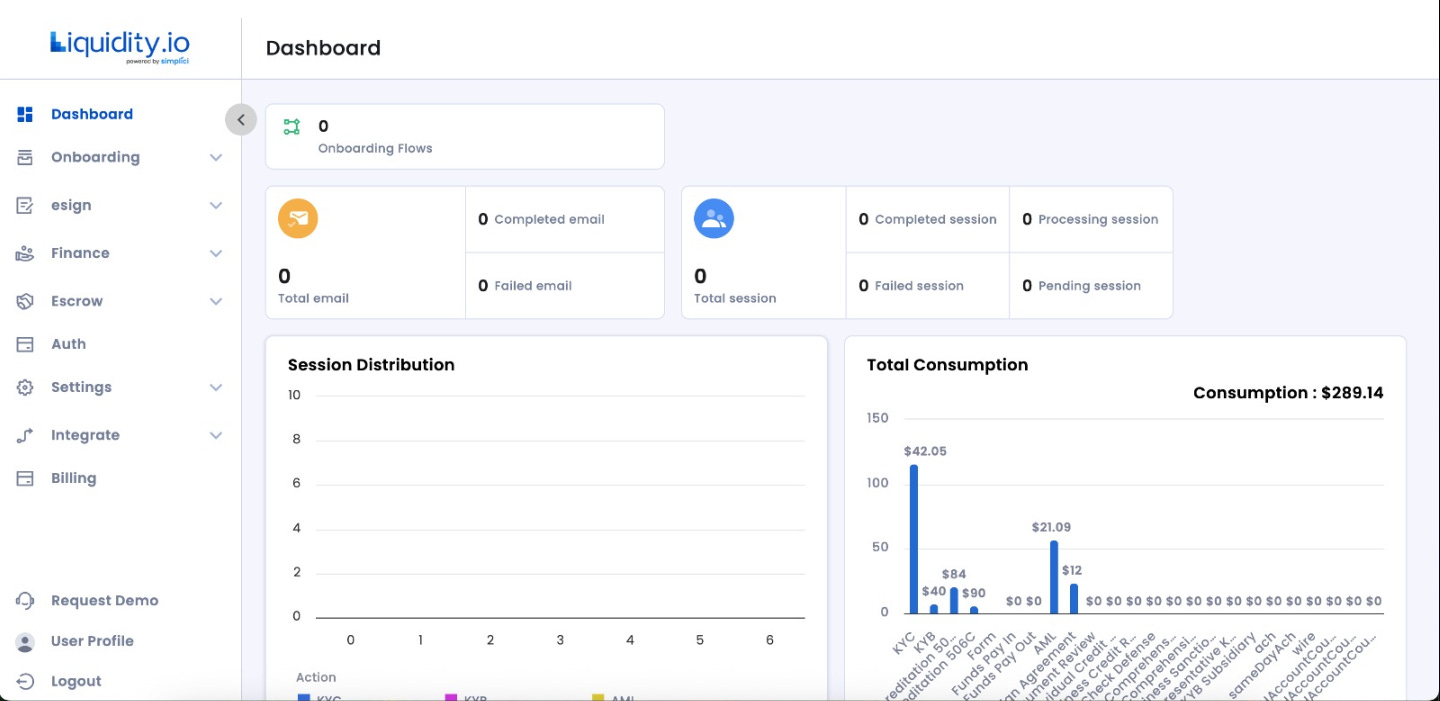

Caption: Simplici.io: One session, full stack—ID, KYC, questionnaires, and agreements.

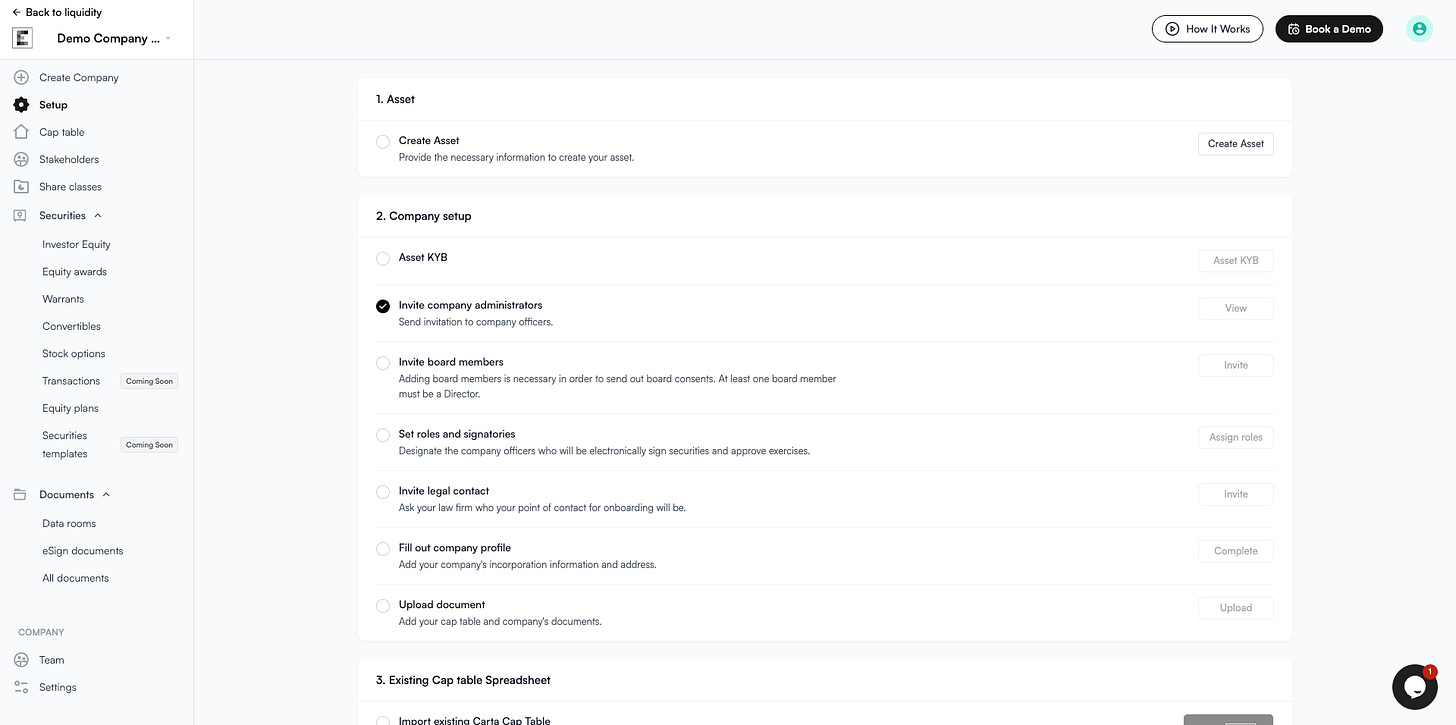

Caption: Equitytable.io: Raise an entity, add shareholders, complete KYB, and finalize docs.

KYC reviews remain slow: Financial institutions averaged 95 days for a KYC review in 2023, up from 84 days in 2022—evidence that manual steps persist despite more tools. Source: Quantexa (Apr 22, 2025). Link. Quantexa

Method: industry analysis referencing global survey benchmarks.Unit cost per KYC review is rising: The average cost per KYC review hit $2,598 in 2023 (+17% YoY), with heavy manual effort cited as the driver. Source: Fenergo (Nov 24, 2023). Link. resources.fenergo.com

Method: global client survey and internal dataset.Compliance spend keeps climbing: Financial crime compliance cost $61B across the U.S. & Canada in 2023, with 99% of firms reporting increases. Source: LexisNexis Risk Solutions (Feb 21, 2024). Link. LexisNexis Risk Solutions

Method: commissioned Forrester study across regulated institutions.Friction kills conversion: ~68% of consumers abandoned digital financial applications, equating to €5.7B in annual lost revenue for financial services. Source: Signicat “State of Digital Identity in Europe 2024–2025” (2024). PDF. 5310879.fs1.hubspotusercontent-na1.net

Method: multi-country consumer survey.Growing accredited investor base: The SEC estimates 18.5% of U.S. households met accredited investor criteria by end-2022 (up from ~1.8% in 1983). Source: SEC Staff Report (Dec 14, 2023). PDF. SEC

Method: SCF-based household estimates; staff analysis.

What this means: The market is expanding, but traditional onboarding is slowing it down and inflating costs. A single-pass, policy-driven approach that unifies biometric checks, KYC/KYB, questionnaires, and agreements can compress cycle time while improving auditability and supervision (see FINRA guidance on digital signatures and controls (Aug 2022) PDF). finra.org

Get 25 LQDTY on successful sign-up.

What is LQDTY? LQDTY is the internal utility used across the Liquidity ecosystem for wallet/account fees, on-chain actions, and access to certain platform features—not an investment product and not presented with price or performance.

How to receive: Complete onboarding and verification; credit typically within 3 business days after account approval.

Subject to eligibility, terms, and compliance checks.

LQDTY powers actions across Liquidity’s infrastructure—covering wallets, transaction fees, and specific feature access.

Learn more on our site: liquidity.io.

Contact

Questions or want a working session with our team? marketing@liquidity.io